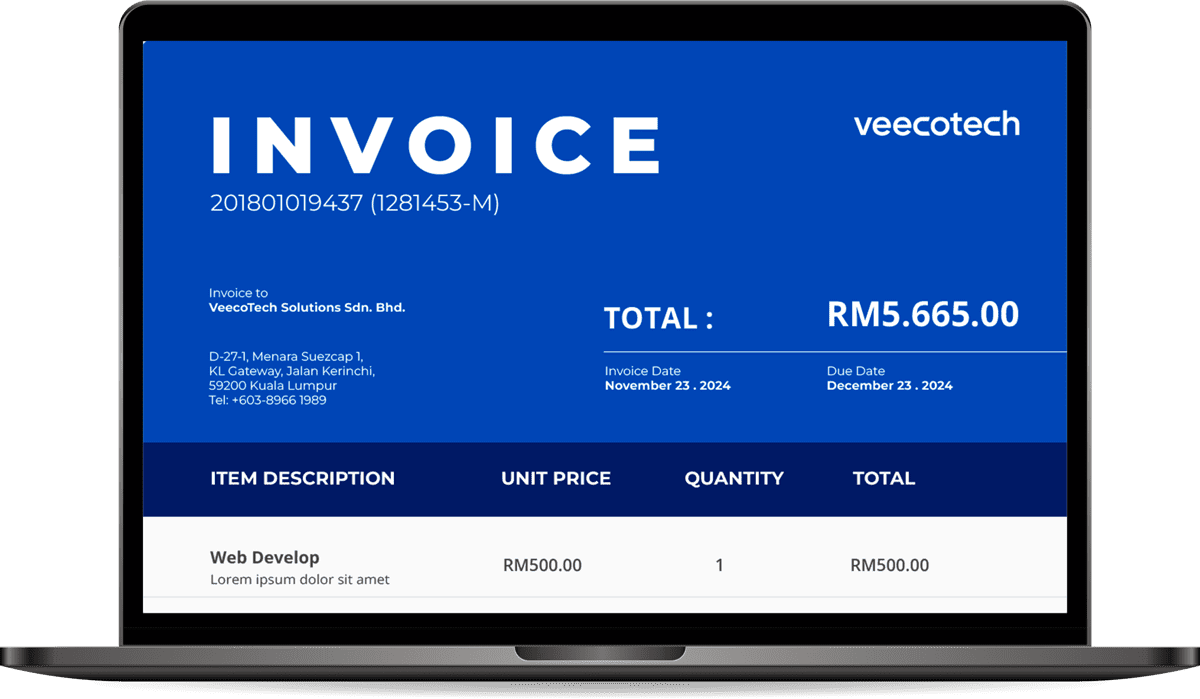

Our E-invoicing Middleware:

Go Invoice

VeecoTech’s e-invoicing middleware solution is designed to streamline your invoicing process, ensuring efficiency, reliability, and compliance, seamlessly integrated with the Inland Revenue Board of Malaysia (LHDN).

01

Intelligent Retry Mechanism

This mechanism as a bridge between your ERP system and LHDN. If the initial attempt to connect with LHDN fails due to temporary issues, the system automatically retries, ensuring your invoices are submitted without manual intervention.

02

100% LHDN Compliance

Stay up-to-date with regulatory changes automatically, as our system is regularly updated to reflect new compliance standards by the dedicated team at VeecoTech.

03

User-Friendly Login Interface

Ensuring our system is simple for users to access and manage their invoicing tasks is key with a user-friendly interface designed for users of any skill level to easily navigate and use.

04

LHDN Recommended Invoice Format

Easily download invoices in the LHDN recommended format directly from our system, consisting of all 55 required fields.

05

Authorized Digital Certificate & Signature

Working with MDEC-appointed Licensed Certification Authority, the system ensures every invoice submitted consists of a compulsory unique digital signature.

06

Integration with your ERP system

VeecoTech’s e-invoicing middleware seamlessly integrates with your existing ERP systems, synchronizing invoicing data, enhancing operational efficiency, and maintaining accurate financial records.

07

Reporting

Our comprehensive reporting capabilities provide you with detailed insights into your invoicing operations.